ev charger tax credit 2022

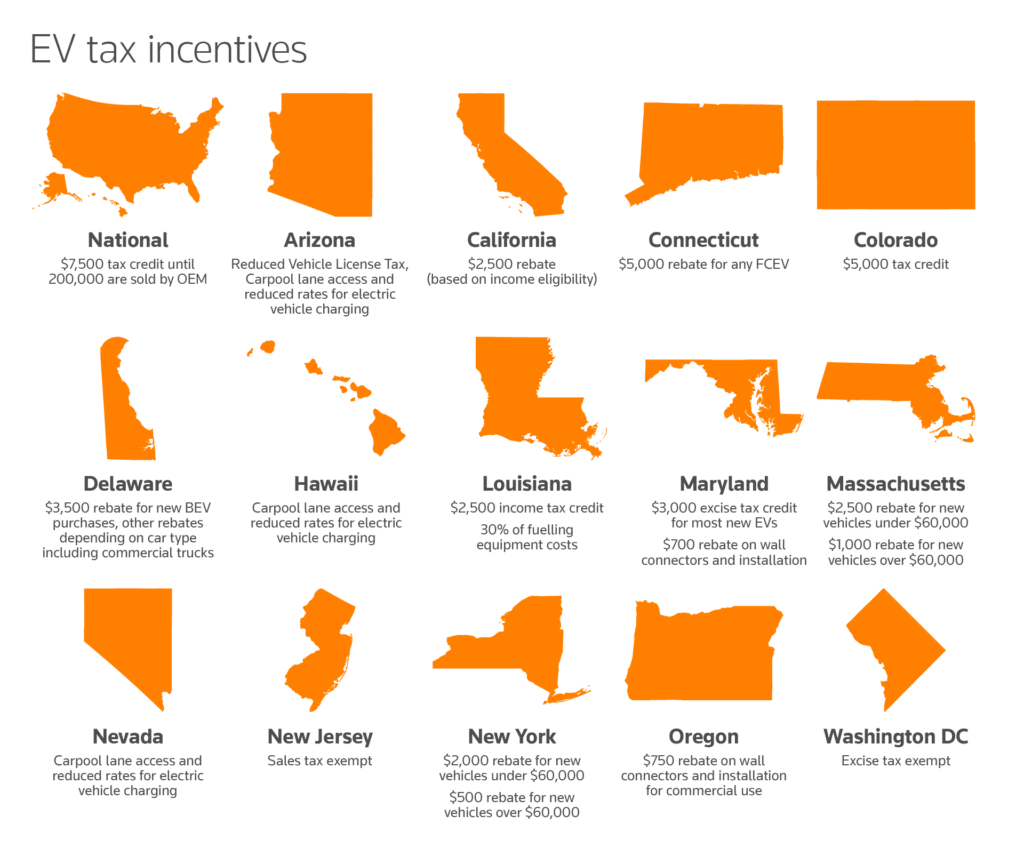

As of February 2022 residents in any state can get an income tax credit to help defray the cost of both EV chargers and EV charger installations. Until recently many EVs were eligible for a 7500 tax credit.

Residential Solar Installers Get Versed In Ev Chargers

Colorado EV Tax Credits.

. When President Biden signed the Inflation Reduction Act on August 17 a new rule took effect requiring that final assembly of EVs must occur in North. Federal EV Charging Tax Credit. This incentive covers 30 of.

Maryland offers a tax credit up to 3000 for qualified. The 2022 Niro EV was a steal for 31590 because it. The Ariya will be eligible for any federal tax incentives in the short term after the Inflation Reduction Act of 2022s recent overhaul of EV tax credit rules.

How much is the. Iowa EV tax rebate. Save up to 1000 on charging your EV at home.

Youll have to keep its total price under 80000 to qualify for the new tax credit. It provides a valuable incentive for installing EV charging-related hardware. Credits are also available for.

To recharge an electric vehicle but only if the recharging. Before the Inflation Reduction Act the limit on the amount of the EV charger tax credit for businesses was 30000 which still applies to projects completed before the end of. Before the Inflation Reduction Act the limit on the amount of the EV charger tax credit for businesses was 30000 which still applies to projects completed before the end of.

1 day agoPublished Oct 28 2022 Updated Oct 28 2022 2 min read On an earnings call it sounds like GMs EVs wont qualify for the full EV tax credit out of the gate. If you want to further maximize your tax credits you can also get a tax credit for storage batteries solar water heaters and residential fuel cells. The F-150 Lightning is currently the only electric full-size pickup on the market and its a huge hit.

However the signing of the Inflation Reduction Act in. EV Tax Credit Expansion. The Act demands the critical minerals used in an EVs battery come from the USA or a country with a US free trade agreement.

The Federal 30C Tax Credit was renewed as part of the Inflation Reduction Act IRA of 2022. Meeting this criterion gives the EV a 3750 tax. 2022 EV Tax Credit Changes.

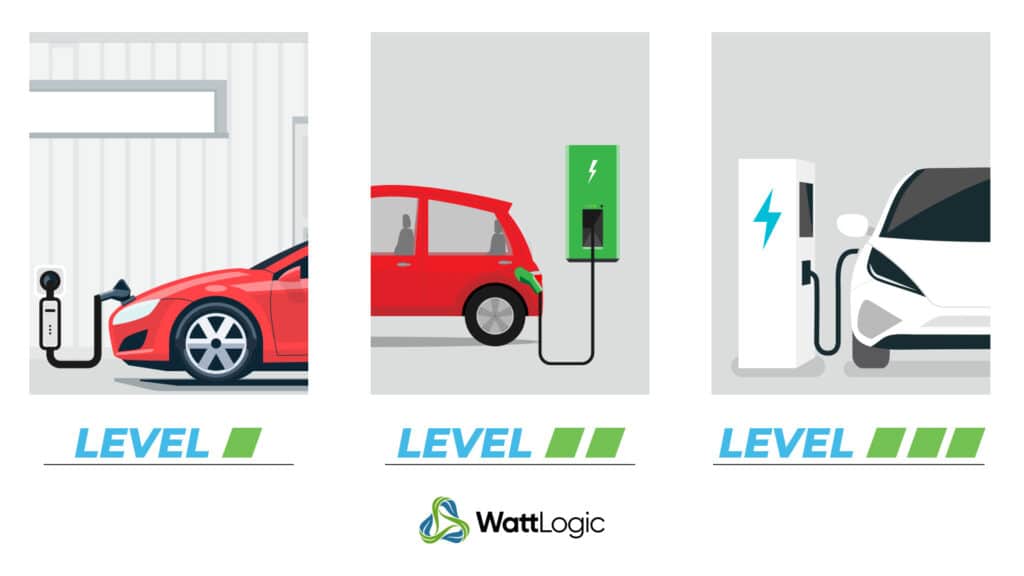

The Inflation Reduction Act IRA revives a tax credit that previously expired at the end of 2021 for installing a home EV charger. The federal government offered an EV charger tax credit known as the Alternative Fuel Infrastructure Tax Credit for equipment and installation. 2 days agoFor Level 2 charging.

Use the January 2022 revision of Form 8911 for tax years beginning in 2021 or later until a later revision is issued. Taxpayers are eligible for a credit of 30 of the hardware and installation costs for EV chargers installed in their homes after December 31 2021. If you buy or convert a light-duty EV in Colorado you may be eligible for a 2500 tax credit 1500 for leasing in 2022.

2022 EV Tax Credits. After the federal electric vehicle tax incentive its price was closer to 31590. Federal tax credit gives individuals 30 off a ChargePoint Home Flex electric vehicle charging station plus installation costs up to.

First and foremost for EVs placed into service after December 31 2022 the Inflation Reduction Act extends the up to 7500 EV tax credit for 10. Illinois offers a 4000 electric vehicle rebate instead of a tax credit. The 2022 Kia Niro EV has an MSRP of 39090.

This means you can claim 30 percent of the EV. Technically referred to as the Alternative Fuel Vehicle Refueling Property Credit the Section 30C tax credit will come back into force for charging stations placed in service. This is a one-time.

Maine electric vehicle rebates.

Automakers Jack Prices Of Popular Electric Vehicles As Congress Passes Ev Tax Credit Katv

Best Federal Tax Credits Rebates On Ev Charging Stations

Tax Credit For Electric Vehicle Chargers Enel X Way

What To Know About The Federal Tax Credit For Electric Cars Capital One Auto Navigator

Ev Tax Credit 2022 Updates Shared Economy Tax

So You Re In The Market For An Electric Vehicle Here S How The New Federal And Mass Laws Will Help Wbur News

How Do Electric Car Tax Credits Work Kelley Blue Book

Electric Vehicle Tax Credit Complete Guide 2022 Update

The Ev Tax Credit Can Save You Thousands If You Re Rich Enough Grist

Biden Admin Says About 20 Models Will Still Qualify For Ev Tax Credits Techcrunch

Best Federal Tax Credits Rebates On Ev Charging Stations

How Much Does A Commercial Ev Charging Station Cost Wattlogic

Electric Vehicle Tax Credits What To Know In 2022 Bankrate

Inflation Reduction Act Ev Tax Credits Could Hurt Sales

The Federal Tax Credit For Electric Vehicle Chargers Is Back Eq Mag Pro The Leading Solar Magazine In India

U S Says About 20 Models Will Get Ev Credits Through End Of 2022 Reuters

Federal Tax Credit For Ev Charging Stations Installation Extended 2022 Clippercreek By Enphase

How To Claim Your Federal Tax Credit For Home Charging Chargepoint

Which Vehicles Qualify For New 7 500 Electric Vehicle Tax Credit Cpa Practice Advisor